There’s a lot to know about credit so that we won’t expect to make you an expert here. We’re going to focus on just a few topics that matter when getting a mortgage loan. To get comprehensive credit information and a FREE credit report (once per year) visit www.myFICO.com.

Blog articles in the left sidebar will be about credit.

[tabs] [tab title=”Credit Score”]

There’s a very sophisticated computer program that was developed by two guys whose last names were Fair and Isacc. They started the Fair Isaac Company and their credit scoring model “FICO” was named after the first letters of their company name, F.I.Co. This model has evolved over decades and it has become very accurate at using past credit performance to predict a borrower’s future credit behavior. That’s why it is so widely used today.

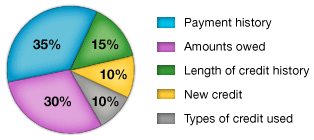

Here’s what is measured in your credit score. You can readily see from the pie chart that Payment History, or how timely you pay your bills, is the single most important factor. It accounts for more than a 3rd of your score. This section is also influenced by collections, judgements or write-offs that have been filed against your name.

However, payment history is obviously not the only factor. The Amounts Owed or more specifically, the amounts that are owed relative to your credit limits is also a significant factor (30%).

The Length of Credit History, how long you have had credit is the next most important factor (15%).

Lastly, any recent, New Credit and your credit mix, the Types of Credit Used both contribute 10% each towards your score. New credit and/or credit inquiries are an important part of your score, because they represent a new credit obligation (potential default) that has uncertain payment history. The credit mix is important because it allows the computer model to build a more comprehensive picture of your credit profile.

[/tab] [tab title=”Improving My Score”] To minimize RISK to the lender, they will review your credit profileSince they can’t read the future, they can’t really know if you will make your mortgage payments on time or not.

However, research has shown that the best way to predict your FUTURE “on-time payment performance” is to review your PAST payment performance. That’s why your credit report it so important. It allows them to get a very complete picture of your outstanding debt obligations, your on-time payment track record, your credit mix and details about any other monies owed. Collections, judgements, etc.

Understanding your credit profile does not eliminate their risk. You might still default in the future even though you’ve been perfect in the past.

However, it does minimize their RISK.

[/tab] [tab title=”Credit Strategy”] Capacity is the funds available in your personal savings…… or funds from other approved sources. Capacity is your financial ability to perform on your commitment. The lender wants to make sure that you have enough money for your required down payment and/or closing costs.

They also want to minimize their RISK by better understanding your reserves, that is, the money that you will have leftover after the transaction is complete. In the case of financial challenge, they want to make sure that you are stable enough so that you can weather a “financial storm”.

The amount of money that you pay towards the following items can reduce your tax basis:

[/tab] [tab title=”MythBusters”] Being clear about the properties value…Fallacy: My score determines whether or not I get credit.

Fact: Lenders use a number of facts to make credit decisions, including your FICO® score. Lenders look at information such as the amount of debt you can reasonably handle given your income, your employment history, and your credit history. Based on their perception of this information, as well as their specific underwriting policies, lenders may extend credit to you although your score is low, or decline your request for credit although your score is high.

Fallacy: A poor score will haunt me forever.

Fact: Just the opposite is true. A score is a “snapshot” of your risk at a particular point in time. It changes as new information is added to your bank and credit bureau files. Scores change gradually as you change the way you handle credit. For example, past credit problems impact your score less as time passes. Lenders request a current score when you submit a credit application, so they have the most recent information available. Therefore by taking the time to improve your score, you can qualify for more favorable interest rates. See how improved scores can lead to savings.

Fallacy: Credit scoring is unfair to minorities.

Fact: Scoring considers only credit-related information. Factors like gender, race, nationality and marital status are not included. In fact, the Equal Credit Opportunity Act (ECOA) prohibits lenders from considering this type of information when issuing credit. Independent research has been done to make sure that credit scoring is not unfair to minorities or people with little credit history. Scoring has proven to be an accurate and consistent measure of repayment for all people who have some credit history. In other words, at a given score, non-minority and minority applicants are equally likely to pay as agreed.

Fallacy: Credit scoring infringes on my privacy.

Fact: Credit scoring evaluates the same information lenders already look at – the credit bureau report, credit application and/or your bank file. A score is simply a numeric summary of that information. Lenders using scoring sometimes ask for less information – fewer questions on the application form, for example.

Fallacy: My score will drop if I apply for new credit.

Fact: If it does, it probably won’t drop much. If you apply for several credit cards within a short period of time, multiple requests for your credit report information (called “inquiries”) will appear on your report. Looking for new credit can equate with higher risk, but most credit scores are not affected by multiple inquiries from auto or mortgage lenders within a short period of time. Typically, these are treated as a single inquiry and will have little impact on the credit score.

back to Learning Center

If You are interested in buying drugs online, now it is the time to start. With the Internet flooded with numerous web-sites selling divers medicaments, buying drugs online is no longer a dream for common man. There isn’t anything you can’t buy online anymore. Diflucan (fluconazole), most popular of a new class of triazole antifungal agents, is available as a sterile solution for intravenous use in plastic containers. Many web-sites offer to their customers Cialis. If you’re concerned about sexual heartiness problem, you perhaps know about cialis price comparison. What patients talk about price cialis? Probably you already read about it. What are the symptoms of sexual diseases? Practically, a medic reviews found that up to half of men on these remedy experience side effects. Such disease is best solved with professional help, commonly through counseling with a certified doctor. Your physician can can offer some treatments that is best for you and your partner. Finally most side effects vary depending on the patient’s weight and other factors. If you need advice about Cialis, one of doctors will make existing medicines that are suitable for you to take. You will then be able to order the generic.